Multiple Choice

What are the correct monthly rates for calculating failure to file and failure to pay penalties?

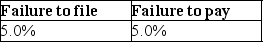

A)

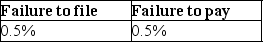

B)

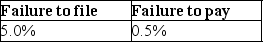

C)

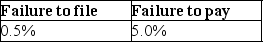

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q7: Vertical equity means that<br>A)taxpayers with the same

Q8: What is an important aspect of a

Q23: Leonard established a trust for the benefit

Q62: When a change in the tax law

Q63: The Senate equivalent of the House Ways

Q66: Which is not a component of tax

Q71: Regressive tax rates decrease as the tax

Q76: When new tax legislation is being considered

Q421: Explain how returns are selected for audit.

Q967: A presidential candidate proposes replacing the income