Essay

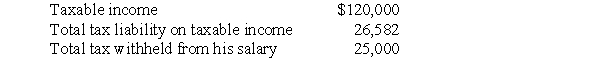

Frederick failed to file his 2017 tax return on a timely basis.In fact,he filed his 2017 income tax return on October 31,2018, (the due date was April 17,2018)and paid the amount due at that time.He failed to make timely extensions.Below are amounts from his 2017 return:

Frederick sent a check for $1,582 in payment of his liability.He thinks that he has met all of his financial obligations to the government for 2017.For what additional amounts may Frederick be liable assuming any applicable interest rate is 6%?

Frederick sent a check for $1,582 in payment of his liability.He thinks that he has met all of his financial obligations to the government for 2017.For what additional amounts may Frederick be liable assuming any applicable interest rate is 6%?

Correct Answer:

Verified

Since Frederick's return is filed late a...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q32: Sarah contributes $25,000 to a church.Sarah's marginal

Q35: Which of the following is not a

Q50: Which of the following is not a

Q50: When returns are processed,they are scored to

Q51: Mia is self-employed as a consultant.During 2017,Mia

Q56: Briana,who is single,has taxable income for 2017

Q56: Individuals are the principal taxpaying entities in

Q57: Limited liability companies may elect to be

Q81: If a taxpayer's total tax liability is

Q85: Until about 100 years ago,attempts to impose