Multiple Choice

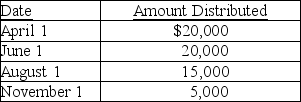

Exit Corporation has accumulated E&P of $24,000 at the beginning of the current tax year.Current E&P is $20,000.During the year,the corporation makes the following distributions to its sole shareholder who has a $22,000 basis for her stock.  The treatment of the $15,000 August 1 distribution would be

The treatment of the $15,000 August 1 distribution would be

A) $15,000 is taxable as a dividend; $5,000 from current E&P and the balance from accumulated E&P.

B) $15,000 is taxable as a dividend from accumulated E&P.

C) $4,000 is taxable as a dividend from accumulated E&P,and $11,000 is tax-free as a return of capital.

D) $5,000 is taxable as a dividend from current E&P,and $10,000 is tax-free as a return of capital.

Correct Answer:

Verified

Correct Answer:

Verified

Q31: Jerry purchased land from Winter Harbor Corporation,

Q32: Payment Corporation has accumulated E&P of $19,000

Q39: Identify which of the following statements is

Q41: A partial liquidation of a corporation is

Q49: Identify which of the following statements is

Q62: Corporations may always use retained earnings as

Q80: Family Corporation, a corporation controlled by Buddy's

Q82: Identify which of the following statements is

Q89: A corporation distributes land and the related

Q99: Which of the following transactions does not