Multiple Choice

Perch Corporation has made paint and paint brushes for the past ten years.Perch Corporation is owned equally by Arnold,an individual,and Acorn Corporation.Perch Corporation has $100,000 of accumulated and current E&P.Both Arnold and Acorn Corporation have a basis in their stock of $10,000.Perch Corporation discontinues the paint brush operation and distributes assets worth $10,000 each to Arnold and Acorn Corporation in redemption of 20% of their stock.Due to the distribution,Arnold and Acorn Corporation must report:

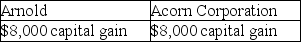

A)

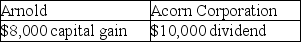

B)

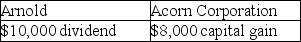

C)

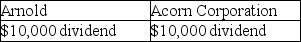

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Rose has a $20,000 basis in the

Q14: Identify which of the following statements is

Q23: Identify which of the following statements is

Q27: Peter owns all 100 shares of Parker

Q30: The Sec. 318 family attribution rules can

Q36: Identify which of the following statements is

Q58: Identify which of the following statements is

Q69: Kiara owns 100% of the shares of

Q75: Identify which of the following statements is

Q84: In a taxable distribution of stock, the