Multiple Choice

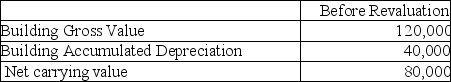

Grover Inc wishes to use the revaluation model for this property:

The fair value for the property is $100,000.What amount would be booked to the "accumulated depreciation" account if Grover chooses to use the elimination method to record the revaluation?

A) $20,000 credit.

B) $40,000 debit.

C) $40,000 credit.

D) $80,000 debit.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Which statement is not correct?<br>A)Impairment testing is

Q27: Based on the following information,what is the

Q29: What impairment,if any,exists on these product lines?<br><img

Q31: Which statement is not correct?<br>A)Accounting for biological

Q33: Grover Inc wishes to use the revaluation

Q37: Wilson Inc wishes to use the revaluation

Q51: Sigma Company has a piece of equipment

Q75: Which of the following is correct with

Q109: Which statement is correct?<br>A)The revaluation model is

Q115: What information is not necessary about discontinued