Multiple Choice

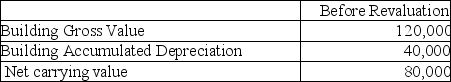

Wilson Inc wishes to use the revaluation model for this property:

The fair value for the property is $20,000.Assuming this is the first year of using the revaluation model,what amount would be booked to the "other comprehensive income" account if Wilson chooses to use the proportional method to record the revaluation?

A) $0

B) $30,000 debit.

C) $30,000 credit.

D) $60,000 debit.

Correct Answer:

Verified

Correct Answer:

Verified

Q46: What are "costs of disposal"?<br>A)The incremental costs

Q53: Which statement is correct?<br>A)Vines are biological assets

Q62: Which of the following is correct with

Q92: What is "agricultural activity"?<br>A)The harvested product of

Q109: Based on the following information,what is the

Q110: Wilson Inc wishes to use the revaluation

Q111: The following information is available about George

Q114: Wilson Inc wishes to use the revaluation

Q116: On December 31,2018,CA Inc.had a machine with

Q117: What is the recoverable amount for this