Multiple Choice

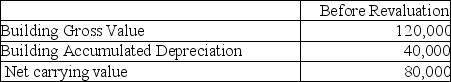

Wilson Inc wishes to use the revaluation model for this property:

The fair value for the property is $40,000.Assuming this is the first year of using the revaluation model,which of the following amounts will be booked?

A) $40,000 debit to profit and loss.

B) $40,000 credit to profit and loss.

C) $40,000 debit to OCI.

D) $40,000 credit to OCI.

Correct Answer:

Verified

Correct Answer:

Verified

Q27: What is a "disposal group"?<br>A)A component of

Q30: Explain why non-current assets held for sale

Q71: Company Twelve purchased land for $900,000 some

Q76: Which statement is correct?<br>A)Agricultural activity relates to

Q80: Reid Resch is a maker of instruments

Q89: Which of the following is correct with

Q89: Information about the PPE for Jeremy Inc.is

Q105: What is a "component" of an entity?<br>A)A

Q113: Explain how an impairment loss is allocated

Q121: Which of the following is not a