Multiple Choice

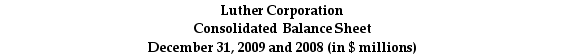

Use the table for the question(s) below.

Consider the following balance sheet:

-When using the book value of equity,the debt to equity ratio for Luther in 2009 is closest to:

A) 0.43

B) 2.29

C) 2.98

D) 3.57

Correct Answer:

Verified

Correct Answer:

Verified

Q24: Zoe Dental Implements has gross property,plant and

Q36: Use the following information for ECE incorporated:<br><img

Q36: For the year ending December 31,2009 Luther's

Q38: Luther Corporation's stock price is $39 per

Q49: The Dodd-Frank Wall Street Reform and Consumer

Q50: Dustin's Donuts experienced a decrease in the

Q52: Use the information for the question(s)below.<br>In November

Q79: Off-balance sheet transactions are required to be

Q83: Accounts payable is a:<br>A)long-term liability.<br>B)current asset.<br>C)long-term asset.<br>D)current

Q86: Use the information for the question(s)below.<br>In November