Multiple Choice

Use the following information to answer the question(s) below.

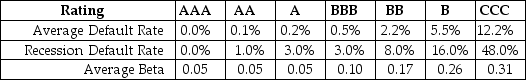

Consider the following information regarding corporate bonds:

-Rearden Metal has a bond issue outstanding with ten years to maturity,a yield to maturity of 8.6%,and a B rating.The bondholders expected loss rate in the event of default is 50%.Assuming a normal economy the expected return on Rearden Metal's debt is closest to:

A) 0.6%

B) 1.6%

C) 4.6%

D) 6.0%

Correct Answer:

Verified

Correct Answer:

Verified

Q7: In a world with taxes,which of the

Q8: In practice which market index would best

Q26: Which of the following statements is FALSE?<br>A)The

Q31: Use the following information to answer the

Q67: Use the following information to answer the

Q69: In practice which market index is most

Q70: Use the table for the question(s)below.<br>Consider the

Q73: Use the following information to answer the

Q76: Use the following information to answer the

Q98: Use the following information to answer the