Multiple Choice

Use the following information to answer the question(s) below.

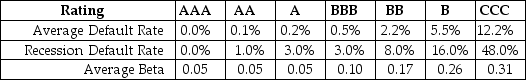

Consider the following information regarding corporate bonds:

-Nielson Motors plans to issue 10-year bonds that it believes will have an BBB rating.Suppose AAA bonds with the same maturity have a 3.5% yield.Assume that the market risk premium is 5% and the expected loss rate in the event of default on the bonds is 60%.The yield that these bonds will have to pay during average economic times is closest to:

A) 3.50%

B) 3.75%

C) 4.00%

D) 5.50%

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Use the following information to answer the

Q14: Use the following information to answer the

Q17: Use the equation for the question(s)below.<br>Consider the

Q20: Firms should adjust for execution risk by:<br>A)assigning

Q28: Your firm is planning to invest in

Q32: Which of the following is NOT considered

Q35: Use the following information to answer the

Q79: The firm's unlevered (asset)cost of capital is:<br>A)the

Q86: Use the following information to answer the

Q93: Use the following information to answer the