Multiple Choice

Use the table for the question(s) below.

Consider the following covariances between securities:

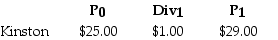

-Suppose you have $10,000 in cash to invest.You decide to sell short $5000 worth of Kinston stock and invest the proceeds from your short sale,plus your $10,000 into one-year U.S.treasury bills earning 5%.At the end of the year,you decide to liquidate your portfolio.Kinston Industries has the following realized returns:

The return on your portfolio is closest to:

A) -0.5%

B) 13.5%

C) -2.5%

D) 14.5%

Correct Answer:

Verified

Correct Answer:

Verified

Q25: Which of the following statements is FALSE?<br>A)When

Q36: What is the efficient frontier and how

Q41: Which of the following statements is FALSE?<br>A)To

Q58: Use the information for the question(s)below.<br>Suppose you

Q59: Use the information for the question(s)below.<br>Suppose you

Q75: Use the table for the question(s)below.<br>Consider the

Q88: Suppose you invest $15,000 in Merck stock

Q99: Consider an equally weighted portfolio that contains

Q119: Use the information for the question(s)below.<br>Suppose that

Q134: Which of the following statements is FALSE?<br>A)The