Multiple Choice

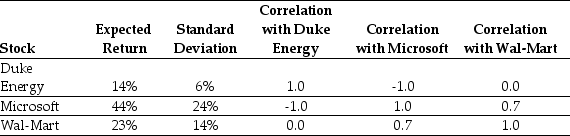

Use the table for the question(s) below.

Consider the following expected returns,volatilities,and correlations:

-Which of the following statements is FALSE?

A) The tangent portfolio is efficient and that,once we include the risk-free investment,all efficient portfolios are combinations of the risk-free investment and the tangent portfolio.

B) The optimal portfolio of risky investments depends on how conservative or aggressive the investor is.

C) By combining the efficient portfolio with the risk-free investment,an investor will earn the highest possible expected return for any level of volatility her or she is willing to bear.

D) The efficient portfolio is the tangent portfolio,the portfolio with the highest Sharpe ratio in the economy.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Use the information for the question(s)below.<br>Tom's portfolio

Q6: Which of the following statements is FALSE?<br>A)A

Q6: Use the table for the question(s)below.<br>Consider the

Q7: Use the information for the question(s)below.<br>Suppose you

Q7: Use the information for the question(s)below.<br>Sisyphean industries

Q8: Use the information for the question(s)below.<br>Suppose that

Q27: Which of the following statements is FALSE?<br>A)We

Q34: Use the information for the question(s)below.<br>Suppose that

Q81: Use the following information to answer the

Q130: Use the information for the question(s)below.<br>Suppose you