Multiple Choice

A proposed new venture will cost $175,000 and should produce annual cash flows of $48,500,$85,000,$40,000,and $40,000 for Years 1 to 4,respectively.The required payback period is 3 years and the discounted payback period is 3.5 years.The required rate of return is 9 percent.Which methods indicate project acceptance and which indicate project rejection?

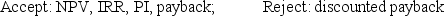

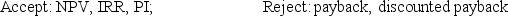

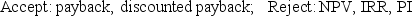

A)

B)

C)

D)

E)

Correct Answer:

Verified

Correct Answer:

Verified

Q24: The net present value method of capital

Q25: The IRR rule is said to be

Q26: The elements that cause problems with the

Q27: The internal rate of return for an

Q28: An investment is acceptable if the payback

Q30: Jack is considering adding toys to his

Q31: When a firm commences a positive net

Q32: The profitability index:<br>A)rule often results in decisions

Q33: A project has an initial cost of

Q34: Graham and Harvey (2001)found that _ were