Essay

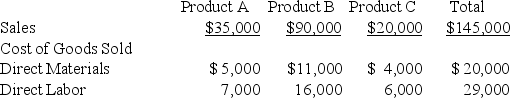

The data given below is taken from the budgeted income statement of the Arrow Corporation for 2019. It shows the projected net income or loss for each of the firm's three products. Management is concerned about the budgeted loss for Product C and wants to discontinue it. Prepare an analysis indicating the effects of discontinuing Product C. Based on the analysis, indicate the decision that should be made.

Additional information:

(a.)Materials and labor are variable costs.

(b.)Total manufacturing overhead is applied at 50 percent of the direct labor costs. (c.)Variable overhead is 10 percent of the direct labor costs.

(d.)Fixed overhead totals $11,600 a year.

(e.)Operating expenses include variable costs at 20 percent of sales dollars. (f.)Fixed operating expenses total $18,000.

(g.)Fixed overhead costs and fixed operating expenses are expected to continue if Product C is eliminated.

Correct Answer:

Verified

ARROW CORPORATION

Income Statement

Year ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Income Statement

Year ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q106: Timkon Manufacturing has provided the following

Q107: Which of the following costs can be

Q108: Which of the following is not relevant

Q109: Which inventory costing system is required by

Q110: In managerial decisions, nonmanufacturing costs can be

Q112: Under the contribution margin approach, common costs

Q113: Which of the following is the first

Q114: The increase in a cost from one

Q115: When the balance in ending finished goods

Q116: If a segment of a business is