Multiple Choice

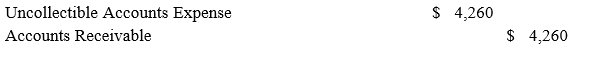

A firm reported sales of $450,000 for the year. Prior to adjustment, Allowance for Doubtful Accounts has a debit balance of $280. Based on an aging of accounts receivable, the firm estimated its losses from uncollectible accounts to be $3,980. The entry to record the estimated bad debt losses will be:

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q77: Uncollectible Accounts Expense can be called Loss

Q78: Common internal controls for accounts receivable would

Q79: The experience of other firms in the

Q80: On December 31, 2019, prior to adjustments,

Q81: On December 31, 2019, prior to adjustments,

Q83: A firm reported net credit sales of

Q84: A firm reported sales of $460,000 for

Q85: At the end of the current year,

Q86: The Salinas Company uses the direct charge-off

Q87: The longer an account is past due,