Short Answer

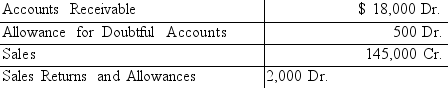

At the end of the current year, the trial balance of Tracey's Consulting Services included the accounts and balances shown below. Credit sales were $90,000. Returns and allowances on these sales were

$1,000. Assume that the firm bases its estimate of the loss from uncollectible accounts on 0.4 percent of net credit sales.

1. What is the estimated loss from uncollectible accounts for the current year?

2. What is the amount of the adjusting entry for the estimated loss from uncollectible accounts?

Correct Answer:

Verified

Correct Answer:

Verified

Q35: Match the accounting description with description by

Q36: On December 31, prior to adjustments, the

Q37: Nigel Lighting uses the <u>direct charge-off method</u>

Q38: If the direct charge-off method of accounting

Q39: Millie's Draperies uses the allowance method of

Q41: On December 31, prior to adjustment, Allowance

Q42: The adjusting entry to record estimated losses

Q43: When the allowance method of recognizing losses

Q44: A firm reported sales of $720,000 for

Q45: To achieve good internal control over accounts