Short Answer

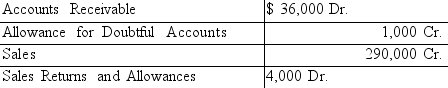

At the end of the current year, the trial balance of Daniels' Furniture Store included the accounts and balances shown below. Credit sales were $180,000. Returns and allowances on these sales were

$2,000. Assume that the firm bases its estimate of the loss from uncollectible accounts on 0.4 percent of net credit sales.

1. What is the estimated loss from uncollectible accounts for the current year?

2. What is the amount of the adjusting entry for the estimated loss from uncollectible accounts?

Correct Answer:

Verified

Correct Answer:

Verified

Q59: A firm using the allowance method to

Q60: Allowance for Doubtful Accounts has a credit

Q61: The balance of the Allowance for Doubtful

Q62: Allowance for Doubtful Accounts is classified as<br>A)a

Q63: When there is a partial collection of

Q65: Which of the following statements is not

Q66: Under the Allowance Method of accounting for

Q67: A firm reported sales of $300,000 for

Q68: Millie's Draperies uses the allowance method of

Q69: At the end of the current year,