Essay

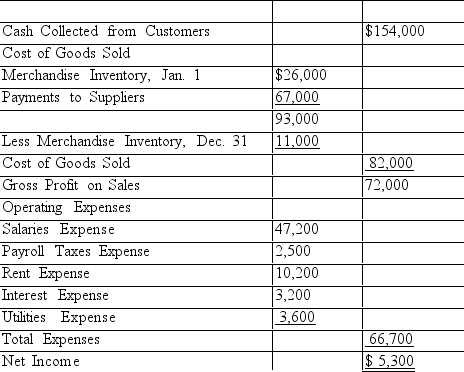

The income statement shown below was prepared and sent by Curtis Brown, the owner of Curt's Crafts, to several of his creditors. The business is a sole proprietorship that sells crafts and toys. An accountant for one of the creditors looked over the income statement and found that it did not conform to generally accepted accounting principles. Using the following additional information provided by the owner, prepare an income statement in accordance with generally accepted accounting principles.

Income Statement

CURT'S CRAFTS

Year Ended December 31, 2019

Additional information provided by owner:

1.On December 31, 2019, accounts receivable from customers total $32,000. On January 1, 2019, accounts receivable totaled $52,000.

2.The beginning and ending merchandise inventories were valued at their estimated selling price. The actual cost of the ending inventory is estimated to be $6,000. The actual cost of the beginning inventory is estimated to be

$18,000.

3.On December 31, 2019 suppliers of merchandise are owed $16,000. On January 1, 2019, they were owed $11,000.

4.The owner paid himself a salary of $1,600 per month and charged this amount to the Salaries Expense account.

5.A check for $300 to cover the December electric bill on the owner's personal home was issued from the firm's bank account. This amount was charged to Utilities Expense.

Correct Answer:

Verified

CURT'S CRAFTS

Income...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Income...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q80: Because financial statements must be objective and

Q81: The matching principle is being applied when

Q82: The income statement shown below was prepared

Q83: The concept of realization permits a company

Q84: Which of the following is allowed under

Q86: Why is the cost principle dependent on

Q87: Match the description with the accounting terms.

Q88: Explain the following statement. "Investors and creditors

Q89: Which of the following statements is not

Q90: Most businesses follow the general rule that