Multiple Choice

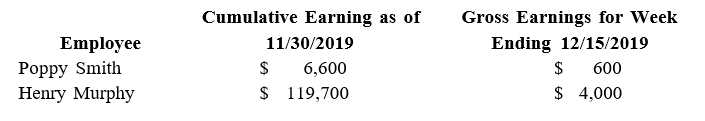

ABC Consulting had two employees with the following earnings information:

-

Use the table above to calculate the employer payroll income taxes associated with Poppy's December 15 paycheck given the following tax rates: Social Security tax of 6.2% is levied on the first $122,700 of annual wages and the Medicare tax rate is 1.45% on all earnings. State unemployment tax of 5.4% and federal unemployment tax of 0.6% are both levied on only the first

$7,000 of each employee's annual earnings.

A) $37.20

B) $45.90

C) $69.90

D) $81.90

Correct Answer:

Verified

Correct Answer:

Verified

Q38: The payroll register of the Fox Manufacturing

Q39: For which of the following is there

Q40: Both the employer and the employee are

Q41: The payroll register of Vtech Enterprises showed

Q42: Mr. Zee worked 48 hours during the

Q44: Which of the following taxes is not

Q45: Jackson Autos has one employee. As of

Q46: All of the following are internal control

Q47: After the Marion Corporation paid its employees

Q48: The frequency of deposits of federal income