Essay

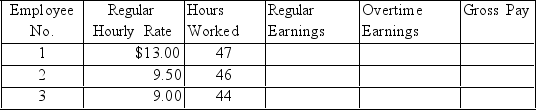

During one week, three employees of the Snowshoe Lodge worked the number of hours shown below. All these employees receive overtime pay at one and a half times their regular hourly rate for any hours worked beyond 40 in a week. Compute the regular earnings, overtime earnings, and gross pay for each employee.

Correct Answer:

Verified

Employee No. 1:Reg. Earn., $520.00; OT E...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: Match the description with the accounting terms.

Q4: The Medicare tax is levied to provide

Q5: Which of the following statements is correct?<br>A)All

Q6: Assuming a Medicare tax rate of 1.45%

Q7: The Santa Fe Company has office employees

Q9: The employer records the amount of federal

Q10: A worker who is paid an agreed

Q11: An _ is paid by the company

Q12: Social Security taxes are paid by:<br>A)the employer

Q13: Ramon Gonzalez's gross pay for the week