Essay

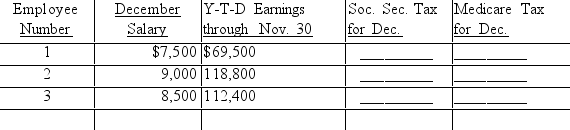

The monthly salaries for December and the year-to-date earnings as of November 30 for the three employees of the Lakeview Medical Center are listed below. Compute the amount of social security tax and Medicare tax to be withheld from each of the employee's gross pay for December. Assume a 6.2 percent social security tax rate on a maximum of $122,700 for the calendar year. Assume a 1.45 percent Medicare tax rate.

Correct Answer:

Verified

Employee No. 1:Soc. Sec. Tax, ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q42: Lisa Ramos has a regular hourly rate

Q43: The total amount earned by the employee

Q44: The Social Security Tax Payable account will

Q45: Identify the list of accounts below that

Q46: During one week, three employees of the

Q48: The column totals in a payroll register<br>A)are

Q49: Employers are required to pay for _

Q50: During the week ended May 15, 2019,

Q51: Identify the list of accounts below that

Q52: During the week ended February 8, 2019,