Essay

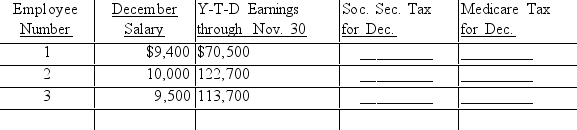

The monthly salaries for December and the year-to-date earnings as of November 30 for the three employees of the Design Warehouse are listed below. Compute the amount of social security tax and Medicare tax to be withheld from each of the employee's gross pay for December. Assume a

6.2 percent social security tax rate on a maximum of $122,700 for the calendar year. Assume a 1.45 percent Medicare tax rate.

Correct Answer:

Verified

Employee No. 1:Soc. Sec. Tax, ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q22: After payroll computations are made, the hours

Q23: Time sheets or time cards are used

Q24: FICA tax is commonly referred to as

Q25: During one week, three employees of

Q26: A person who is hired by a

Q28: An employee whose regular hourly rate is

Q29: During the week ended April 26, 2019,

Q30: Which of the following statements is not

Q31: During the week ended January 11, 2019,

Q32: An employee whose regular hourly rate is