Essay

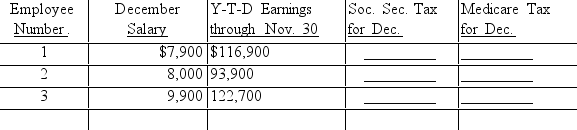

The monthly salaries for December and the year-to-date earnings as of November 30 for the three employees of the Barbara's Bookstore, Inc. are listed below. Compute the amount of social security tax and Medicare tax to be withheld from each of the employee's gross pay for December. Assume a 6.2 percent social security tax rate on a maximum of $122,700 for the calendar year. Assume a

1.45 percent Medicare tax rate.

Correct Answer:

Verified

Employee No. 1:Soc. Sec. Tax, ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q58: Federal law requires employers to withhold which

Q59: The employer records the amount of federal

Q60: Federal law requires employers to pay which

Q61: An employee whose regular hourly rate is

Q62: If an employee whose regular hourly rate

Q64: Salespeople who are paid a percentage of

Q65: The amount debited to Wages Expense when

Q66: If an employee works for more than

Q67: Rick O'Shea, the only employee of Hunter

Q68: During one week, three employees of