Essay

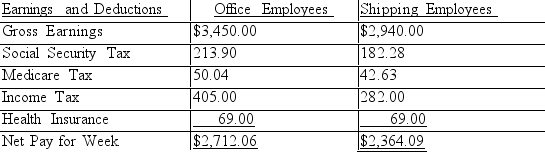

The Burns Company has two office employees and two shipping employees. A summary of their earnings and deductions for the week ended August 23, 2019, is shown below. On page 10 of a general journal, record the August 23 payroll and the entry to summarize the effect of the checks written to pay the payroll.

Correct Answer:

Verified

Correct Answer:

Verified

Q74: An employee whose regular hourly rate is

Q75: Employees of firms engaged in interstate commerce

Q76: ABC Grocers uses a separate checking account

Q77: Lila Harrison's is the sole employee of

Q78: It is best not to pay wages

Q80: Sabrina Duncan had gross earnings for the

Q81: When a firm records its payroll, the

Q82: An employee whose regular hourly rate is

Q83: Michael Miller is paid twice a month

Q84: Social Security Tax is 6.2%; Medicare Tax