Multiple Choice

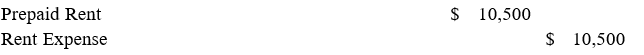

On July 1, Sidney Consulting Services paid $18,000 for 12 months of advance rent on its office building. Select the adjusting entry made on December 31, to record the amount of rent that had expired during the year.

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q1: On a worksheet, the adjusted balance of

Q2: On November 1, 2019, Peaches Consulting Service

Q3: On a balance sheet, Accumulated Depreciation-Equipment is

Q4: On January 1, 2019, Johnson Consulting purchased

Q6: Adjusting entries can be journalized:<br>A)only once per

Q7: If adjustments are entered on a worksheet,

Q8: The account credited in the adjusting entry

Q9: On a worksheet, the adjusted balance of

Q10: Read the description of following adjustments that

Q11: Read the description of following adjustments that