Essay

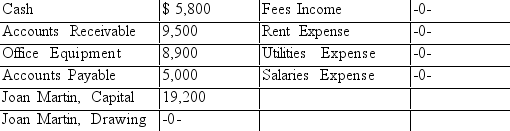

The consulting firm of Martin and Associates uses the accounts listed below. On a separate sheet of paper, set up T accounts for each of the accounts listed and record the balances as of December 1, 2019 on the normal balance side of the accounts.

The firm has the following transactions during the month of December 2019. Record the effects of these transactions in the T accounts.

a. Paid $2,100 for one month's rent

b. Collected $4,500 in cash from credit customers

c. Performed services for $8,300 in cash

d. Paid $5,300 for salaries

e. Issued a check for $2,750 to a creditor

f. Performed services for $11,650 on credit

g. Purchased office equipment for $3,200 on credit

h. The owner withdrew $2,800 in cash for personal expenses

i. Issued a check for $925 to pay the monthly utility bill

Determine the account balances after the transactions have been recorded Prepare a trial balance as of December 31, 2019.

Correct Answer:

Verified

MARTIN...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

MARTIN...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q43: The following information should be used for

Q44: Conway Copy Shop is owned and operated

Q45: The T account balances for the accounts

Q46: Which of the following types of accounts

Q47: Conway Copy Shop is owned and operated

Q49: The difference between the debit and credit

Q50: The order in which financial statements are

Q51: Credits increase Liabilities, Owner's Equity, and Revenue.

Q52: A small pencil figure written at the

Q53: A business performed $8,000 of services. Their