Multiple Choice

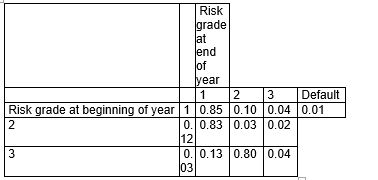

Consider the following hypothetical transition matrix: Risk grade at end of year Which of the following statements is true?

Which of the following statements is true?

A) A borrower with a risk grade of 2 at the beginning of the year has a 3 per cent probability of being downgraded to a risk grade of 3.

B) A borrower with a risk grade of 3 at the beginning of the year has a 0.04 per cent probability of being upgraded to a risk grade of 1.

C) A borrower with a risk grade of 2 at the beginning of the year has a 12 per cent probability of being downgraded to a risk grade of 1.

D) A borrower with a risk grade of 2 at the beginning of the year has an 85 per cent probability of being upgraded to a risk grade of 1.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: The term 'transition matrix' refers to a

Q29: Which of the following statements is true?<br>A)FIs

Q30: Consider the following portfolio of assets: <img

Q33: Which of the following is a major

Q34: Consider the following portfolio of assets: <img

Q39: Consider an FI that holds two loans

Q46: FIs can reduce risk by taking advantage

Q49: Assume that the maximum loss as

Q51: Migration analysis is a method to:<br>A)manage loan

Q64: Which of the following statements is true?<br>A)FIs