Multiple Choice

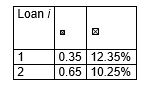

Consider the following table with information on the weightings and expected returns of two assets held by an FI.  What is the expected return on the portfolio (round to two decimals) ?

What is the expected return on the portfolio (round to two decimals) ?

A) (0.35 + 12.35) - (0.65 + 10.25) = 1.80%

B) (0.35 + 0.65) * (12.35 + 10.25) = 22.60%

C) (12.35 + 10.25) / 2 = 11.30%

D) 0.35 * 12.35 + 0.65 * 10.25 = 10.99%

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Financial institutions do not use options to

Q4: A forward contract:<br>A)has more credit risk than

Q6: Assume that the maximum loss as a

Q16: Which of the following statements is true?<br>A)The

Q20: Consider the following portfolio of assets:

Q31: Which of the following is a major

Q38: Which of the following statements is true?<br>A)As

Q55: Which of the following statements is true?<br>A)One

Q56: Which of the following statements is true?<br>A)The

Q71: Loan sales and securitisation are increasingly seen