Essay

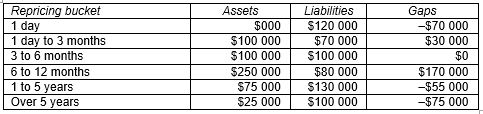

Consider the following repricing buckets and gaps:  What is the annualised change in the bank's future net interest income if the overnight interest rate increased by 100 basis points?

What is the annualised change in the bank's future net interest income if the overnight interest rate increased by 100 basis points?

A)-$700

B)$700

C)-$7000

D)$700

Correct Answer:

Verified

Correct Answer:

Verified

Q3: The term 'rate-sensitive assets' refers to assets:<br>A)whose

Q14: Consider the following table: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4570/.jpg" alt="Consider

Q15: Consider the following table: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4570/.jpg" alt="Consider

Q18: The bank has a negative repricing gap.Is

Q21: Consider the following table: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4570/.jpg" alt="Consider

Q25: Outline what is meant by the CGAP

Q27: Which of the following statements is true?<br>A)As

Q37: The term 'runoffs' refers to:<br>A)one-off cash flow

Q42: The repricing gap focuses on the interest

Q70: Assume you are the manager of an