Essay

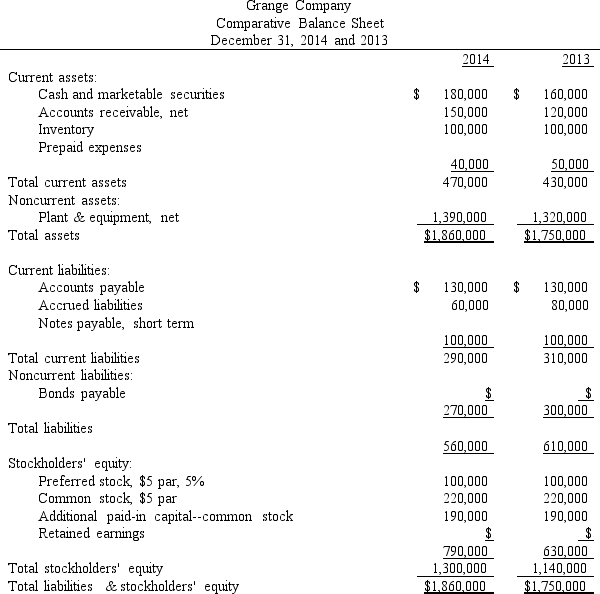

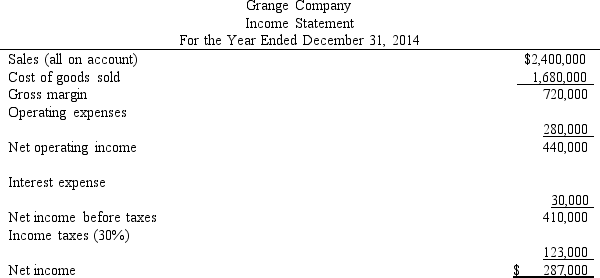

Figure 16-2.Financial statements for Grange Company appear below:

Dividends during 2014 totaled $127,000, of which $5,000 were preferred dividends.The market price of a share of common stock on December 31, 2014, was $100.

Dividends during 2014 totaled $127,000, of which $5,000 were preferred dividends.The market price of a share of common stock on December 31, 2014, was $100.

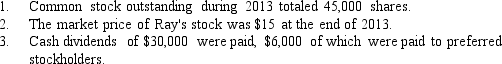

-The income statement for Ray Company for the year ended December 31, 2013, appears below.

*Includes $30,000 of interest expense and $18,000 of income tax expense.

Additional information:

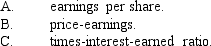

Required: Compute the following ratios for 2013:

Required: Compute the following ratios for 2013:

Correct Answer:

Verified

Correct Answer:

Verified

Q46: Swanson Company had $250,000 of current assets

Q55: Select the ratio that each statement below

Q70: A company has a receivables turnover of

Q73: Match the classifications of ratios with each

Q76: Match the classifications of ratios with each

Q108: Presented below are selected data from

Q111: Figure 16-7<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2048/.jpg" alt="Figure 16-7

Q112: Figure 16-5.The following information that was obtained

Q116: Lisa's Dress Company, a retailer, had cost

Q125: Select the ratio that each statement below