Essay

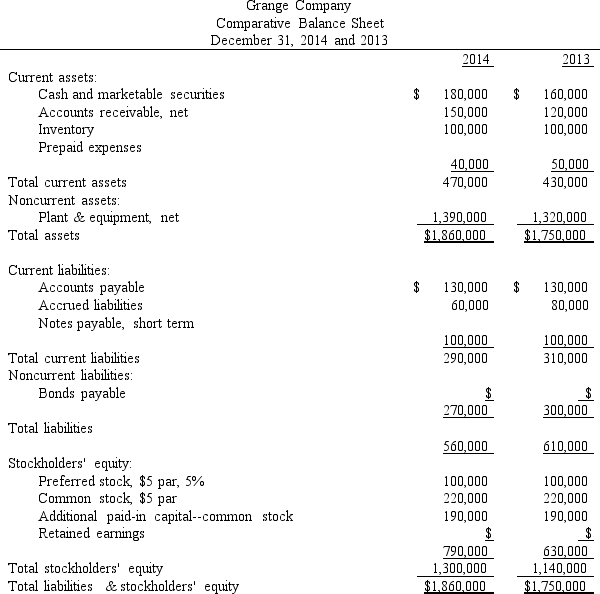

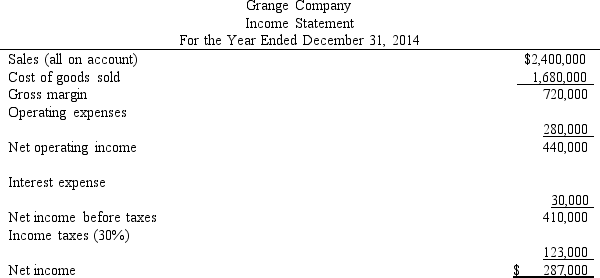

Figure 16-2.Financial statements for Grange Company appear below:

Dividends during 2014 totaled $127,000, of which $5,000 were preferred dividends.The market price of a share of common stock on December 31, 2014, was $100.

Dividends during 2014 totaled $127,000, of which $5,000 were preferred dividends.The market price of a share of common stock on December 31, 2014, was $100.

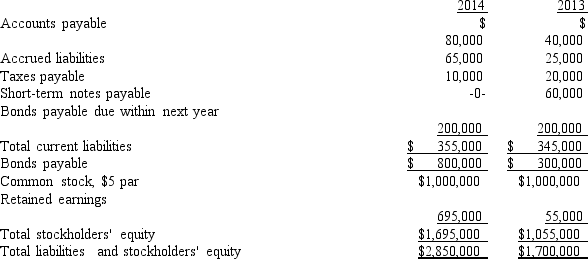

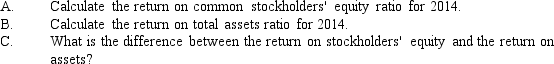

-The following information is available from the balance sheets at the end of 2014 and 2013 for Shelley Company:

Net income for 2014 and 2013 was $340,000 and $300,000, respectively. Interest expense was $45,000 for 2014 and the tax rate is 30%. Answer the following:

Net income for 2014 and 2013 was $340,000 and $300,000, respectively. Interest expense was $45,000 for 2014 and the tax rate is 30%. Answer the following:

Correct Answer:

Verified

Correct Answer:

Verified

Q6: A company measures how efficiently it is

Q8: The Gift Shoppe's inventory turned over five

Q13: The _ is computed by dividing a

Q32: Earnings per share is an indication of

Q103: The measures of the ability of a

Q136: Which profitability ratio requires the use of

Q138: All debt is considered in the computation

Q183: Assume the following sales data for

Q184: Data concerning Bouerneuf Company's common stock follow:

Q185: Horizontal analysis is analysis<br>A) of percentage changes