Multiple Choice

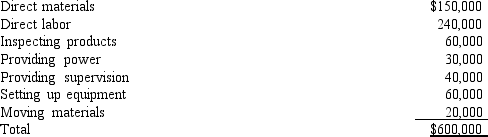

Foster Industries manufactures 20,000 components per year. The manufacturing cost of the components was determined as follows:  If the component is not produced by Foster, inspection of products and provision of power costs will only be 10% of the current production costs; moving materials costs and setting up equipment costs will only be 50% of the production costs; and supervision costs will amount to only 40% of the production amount. An outside supplier has offered to sell the component for $25.50.

If the component is not produced by Foster, inspection of products and provision of power costs will only be 10% of the current production costs; moving materials costs and setting up equipment costs will only be 50% of the production costs; and supervision costs will amount to only 40% of the production amount. An outside supplier has offered to sell the component for $25.50.

What is the effect on income if Foster Industries purchases the component from the outside supplier?

A) $25,000 increase

B) $45,000 increase

C) $90,000 decrease

D) $90,000 increase

Correct Answer:

Verified

Correct Answer:

Verified

Q18: Victor's Detailing customers would be willing to

Q45: In making a short-run decision, all alternatives

Q69: _ is the point at which products

Q103: In short-run decision making, the alternative with

Q128: Classy Carry manufactures two types of handbags,

Q130: If Fuller accepts the special order, by

Q132: Refer to Figure 13-5. What is the

Q135: Refer to Figure 13-4. What is the

Q136: Island Princess Pineapples purchases pineapples from area

Q137: The managers of Computer World are trying