Essay

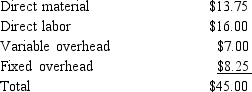

Tapeo Company has always made its electronic components that go into their GPS systems in-house. Streeter Company has offered to supply these electronic components at a price of $38 each. Tapeo uses 18,000 units of these components each year. The cost per unit of this component is as follows:

Assume that 45% of Tapeo Company's fixed overhead would be eliminated if the electronic component was no longer produced in-house.

Assume that 45% of Tapeo Company's fixed overhead would be eliminated if the electronic component was no longer produced in-house.

Required:

A. If Tapeo decided to purchase the electronic component from Streeter Company how much would its operating income increase or decrease?

B. Should Tapeo continue to make the electronic component or buy it from Streeter Company?

Correct Answer:

Verified

A.

B. Tapeo should...

B. Tapeo should...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q62: Matching<br><br>Match each statement with the correct item

Q71: Stadium Company charges cost plus 60%.If the

Q74: The decision on whether to produce a

Q87: Refer to Figure 13-10. Upon hearing of

Q88: Aerotoy Company makes toy airplanes. One plane

Q90: Refer to Figure 13-3. What is the

Q94: Refer to Figure 13-3. What is the

Q95: Reggie Corporation manufactures a single product with

Q97: Auden makes three types of vitamin supplements,

Q111: Target costing can be used most effectively