Essay

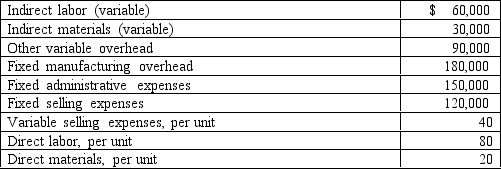

Last year, Baker Company produced 30,000 units and sold 28,000 units. Beginning inventory was zero. During the period, the following costs were incurred: Required: Compute the dollar amount of ending inventory using:

Required: Compute the dollar amount of ending inventory using:

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q91: The economic order quantity (EOQ) is the

Q92: Rudd Company uses 40,000 micro-chips each year

Q93: Ramon Company reported the following units of

Q94: Last year, Fabre Company produced 20,000 units

Q95: Total inventory-related cost consists of ordering cost

Q97: Lost sales and costs of expediting shipments

Q98: Inventory taxes, obsolescence, and insurance are examples

Q99: When the economic order quantity (EOQ) model

Q100: Figure 8-3 Martin Company uses 625 units

Q101: The _ is the number of units