Multiple Choice

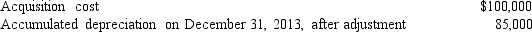

Equipment with an estimated residual value at acquisition of $15,000 was sold on December 31, 2013, for $20,000 cash. The following data were available at the time of sale:  When this transaction is recorded, it should include a

When this transaction is recorded, it should include a

A) debit of $80,000 to the Loss on Disposal account.

B) credit of $20,000 to the Equipment account.

C) credit of $5,000 to the Gain on Disposal account.

D) debit of $20,000 to the Accumulated Depreciation account.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Many companies use MACRS (Modified Accelerated Cost

Q5: One reason management may choose the straight-line

Q49: Flossil Fossils Company purchased a tract of

Q50: Given below are several accounts and balances:<br>

Q52: Focal Point Engineering purchased a trademark at

Q55: A company purchased a building for $900,000

Q57: Below are several accounts and balances from

Q93: Which of the following is not a

Q98: Generally accepted accounting principles (GAAP) require that

Q191: Select the account that would be increased