Essay

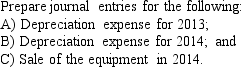

Future Foundations purchased equipment on January 1, 2013, for $50,000, with an estimated useful life of 5 years and an estimated residual value of $5,000. The company uses the straight-line method of depreciation. On July 1, 2015, the equipment was sold for $17,500 cash.

Correct Answer:

Verified

Correct Answer:

Verified

Q26: Falling Leaves Lawn Care<br><br>This company purchased new

Q80: Match these terms with their correct definition.<br>-Exclusive

Q84: Costs incurred related to plant assets that

Q103: Identify where each of the following accounts

Q110: For each of the following items, indicate

Q118: Finnegan's Fixtures purchased molding machines at the

Q119: Finicky Freight purchased a truck at the

Q123: Why do many companies use MACRS Modified

Q147: Which of the following accounts would not

Q151: Land is not depreciated because it<br>A) appreciates