Essay

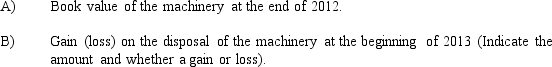

Farley Mills purchased new machinery at the beginning of 2012 for $200,000. The machines had an estimated life of 5 years, an estimated residual value of $25,000, and were depreciated using the straight-line method. At the beginning of 2013, the machines were sold for $150,000 because management was unhappy with their performance.Determine the following amounts:

Correct Answer:

Verified

Correct Answer:

Verified

Q13: An expenditure that does not increase the

Q21: Fabulous Creations<br>The assets section of the company's

Q70: Natural resources can be replaced or restored

Q124: Given below is a list of items

Q132: Fireworks City<br>Information for 2020 and 2019 is

Q177: Equipment with a residual value of $50,000

Q178: Refer to Fabian Woodworks. Based on the

Q180: Refer to Fabian Woodworks. Based on the

Q181: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2047/.jpg" alt=" -Refer to Fireworks

Q192: FASB allows companies to use different depreciation