Essay

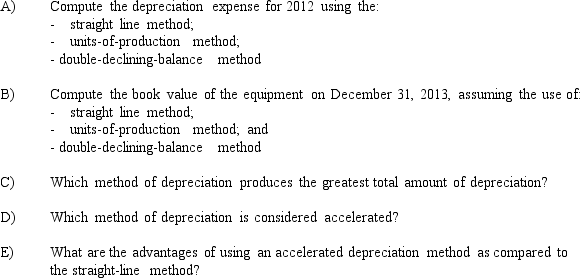

Fields of Green, a turf farm, purchased equipment at the beginning of 2012 for $175,000. In addition, the company paid $6,000 for delivery of the equipment and $4,000 for set up charges. The equipment has an estimated residual value of $5,000 and an estimated life of 10 years or 50,000 hours of operation. The equipment was operated for 5,200 hours in 2012 and 5,000 hours in 2013.

Correct Answer:

Verified

Correct Answer:

Verified

Q32: Match the following terms with their definitions.<br>-Accumulated

Q42: Given the following list of methods of

Q87: Describe the process that allocates the costs

Q105: Current accounting standards indicate that the costs

Q142: Explain the meaning or significance of the

Q143: Given below are costs incurred during 2012

Q147: You have determined that a company uses

Q149: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2047/.jpg" alt=" -Refer to Fireworks

Q155: Given the following list of methods of

Q161: For each of the following items, indicate