Multiple Choice

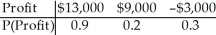

Hugh buys $8,000 worth of stock in an electronics company which he hopes to sell afterward at a profit.The company is developing a new laptop computer and a new desktop computer.If it releases both computers before its competitor,the value of Hugh's stock will jump to $21,000.If it releases one of the computers before its competitor,the value of Hugh's stock will jump to $17,000.If it fails to release either computer before its competitor,Hugh's stock will be worth only $5,000.Hugh believes that there is a 40% chance that the company will release the laptop before its competitor and a 50% chance that the company will release the desktop before its competitor.Create a probability model for Hugh's profit.Assume that the development of the laptop and the development of the desktop are independent events.

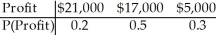

A)

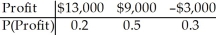

B)

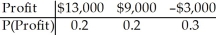

C)

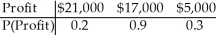

D)

E)

Correct Answer:

Verified

Correct Answer:

Verified

Q24: A company is interviewing applicants for managerial

Q30: You have arranged to go camping for

Q36: The probabilities that a batch of 4

Q47: An insurance policy costs $150 per year,and

Q51: If X and Y are independent random

Q52: Given independent random variables with means and

Q53: Find the standard deviation for the given

Q59: You roll a fair die.If you get

Q75: You roll a pair of dice.If you

Q116: You roll a pair of dice.If you