Multiple Choice

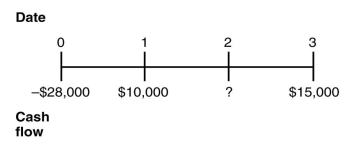

You are offered an investment opportunity that costs you $28,000,has an NPV of $2278,lasts for three years,has interest rate of 10%,and produces the following cash flows:  The missing cash flow from year 2 is closest to:

The missing cash flow from year 2 is closest to:

A) $12,500

B) $12,000

C) $13,000

D) $10,000

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Which of the following statements is false?<br>A)

Q34: You are interested in purchasing a new

Q60: Define the following terms:<br>(a)perpetuity<br>(b)annuity<br>(c)growing perpetuity<br>(d)growing annuity

Q68: The British government has a consol bond

Q69: Consider the following timeline: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1619/.jpg" alt="Consider

Q74: Consider the following timeline detailing a stream

Q75: Use the information for the question(s) below.<br>Suppose

Q76: Which of the following statements is false?<br>A)

Q86: Use the information for the question(s)below.<br>Joe just

Q87: Suppose that a young couple has just