Multiple Choice

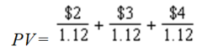

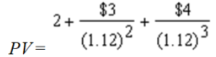

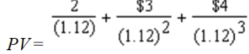

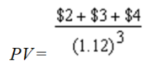

Suppose a professional sports team convinces a former player to come out of retirement and play for three seasons.They offer the player $2 million in year 1,$3 million in year 2,and $4 million in year 3.Assuming end of year payments of the salary,how would we find the value of his contract today if the player has a discount rate of 12%?

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q118: Mendelson Implements records the following cash flows

Q119: What is the effective annual rate of

Q120: Mendez Implements records the following cash flows

Q121: As a result of an injury settlement

Q122: A young couple buys their dream house.After

Q124: A young couple buys their dream house.After

Q125: Your parents set up a trust for

Q126: Your aunt is evaluating her retirement pension.She

Q127: You wish to save $2,500,000 for your

Q128: If you invest $5,000 in a mutual