Multiple Choice

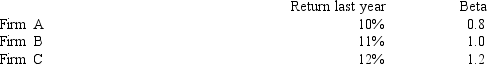

You have the following data on the securities of three firms:  If the risk-free rate last year was 3%,and the return on the market was 11%,which firm had the best performance on a risk-adjusted basis?

If the risk-free rate last year was 3%,and the return on the market was 11%,which firm had the best performance on a risk-adjusted basis?

A) Firm A

B) Firm B

C) Firm C

D) There is no difference in performance on a risk-adjusted basis

Correct Answer:

Verified

Correct Answer:

Verified

Q2: A particular asset has a beta of

Q3: According to the CAPM (capital asset pricing

Q4: NARRBEGIN: Exhibit 7-5<br>Exhibit 7-5<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2250/.jpg" alt="NARRBEGIN:

Q5: A particular stock has an expected return

Q6: The risk-free rate is 5% and the

Q8: Modern financial markets are:<br>A) competitive.<br>B) transparent.<br>C) efficient.<br>D)

Q9: According to the CAPM (capital asset pricing

Q10: The expected possible outcomes for Roxy Stock

Q11: The expected outcomes of Emma Stock are

Q12: Investors can eliminate what type of risk