Multiple Choice

NARRBEGIN: Exhibit 7-1

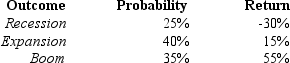

Exhibit 7-1

-Given Exhibit 7-1,what is the expected variance?

A) 957.38%

B) 1058.69%

C) 49.27%

D) 32.54%

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q30: A fund that attempts to researches and

Q31: When investors take a short position in

Q32: The slope of the security market line

Q33: NARRBEGIN: Exhibit 7-1<br>Exhibit 7-1<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2250/.jpg" alt="NARRBEGIN:

Q34: The difference between the return on the

Q36: Which type of firm would most likely

Q37: An investor has $10,000 invested in Treasury

Q38: The risk-free rate is 5% and the

Q39: An asset has a beta of 2.0

Q40: The idea that asset prices fully reflect