Multiple Choice

NARRBEGIN: Exhibit 7-4

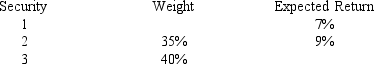

Exhibit 7-4

-Given Exhibit 7-4,if the expected return on the portfolio is 9.7%,what is the expected return for Security 3?

A) 10%

B) 11%

C) 12%

D) 13%

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q38: The risk-free rate is 5% and the

Q39: An asset has a beta of 2.0

Q40: The idea that asset prices fully reflect

Q41: The first step in the risk-based approach

Q42: NARRBEGIN: Exhibit 7-6<br>Exhibit 7-6<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2250/.jpg" alt="NARRBEGIN:

Q44: Suppose Sarah can borrow and lend at

Q45: Asset 1 has a beta of 1.2

Q46: Which of the following statements is true?<br>A)

Q47: A stock that pays no dividends is

Q48: A disadvantage of the probabilistic approach to