Multiple Choice

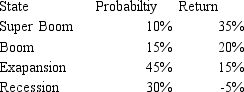

The expected possible outcomes for Roxy Stock are below; what is the expected variance of Roxy Stock?

A) 2.308%

B) 0.053%

C) 2.362%

D) 0.056%

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q47: A stock that pays no dividends is

Q48: A disadvantage of the probabilistic approach to

Q49: Suppose that over the last 25 years,company

Q50: Which type of risk affects many different

Q51: Which of the following is not a

Q53: A portfolio consists 20% of a risk-free

Q54: A drawback to the historical approach of

Q55: An advantage of the probabilistic approach to

Q56: NARRBEGIN: Exhibit 7-5<br>Exhibit 7-5<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2250/.jpg" alt="NARRBEGIN:

Q57: A buy-and-hold strategy:<br>A) typically earns higher returns,after