Essay

In its 2013 annual report,Etowah Company indicated that the number of common shares held in the treasury decreased from 45,546,171 in 2012 to 3,397,381 in 2013.The following also was reported:

By Board authorization,effective December 31,2013 the Company canceled 50 million shares of common stock held in treasury.As a result of the cancellation,common stock decreased by $62.5 million,capital in excess of par value of stock decreased by $114 million,and retained earnings decreased by $1,559.5 million.

The shares canceled or retired represent almost 25 percent of the shares of common stock issued by Etowah.Using the information above,answer the following questions about Etowah Company in order to explain the accounting for the treasury shares by Etowah.

a.Did the company buy any treasury shares during the year?

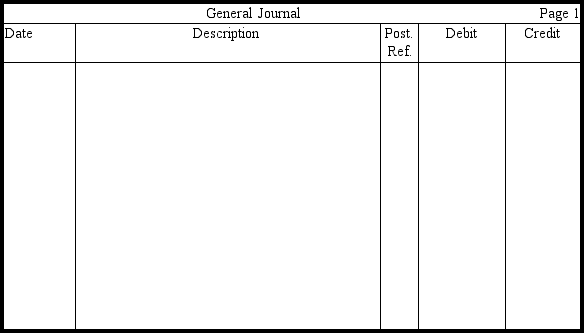

b.Prepare the entry in journal form that was made to record the cancellation or retirement of the treasury shares.(Omit explanations.)

c.At what average price were the treasury shares purchased,and at what average price were they originally issued?

d.What do you think was management's reason for purchasing the treasury shares?

Correct Answer:

Verified

a.Etowah must have purchased about 8,000...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q102: How is it possible for a corporation

Q175: Holders of preferred stock normally do not

Q220: When no-par common stock has a stated

Q221: A corporation's residual equity is its<br>A) preferred

Q222: The company issued 8,000 shares of stock

Q223: The excess of the issuance price over

Q224: No entry is required on the date

Q227: Dividends in arrears are dividends on<br>A) noncumulative

Q228: The following information relates to the number

Q229: A disadvantage of the corporate form of