Essay

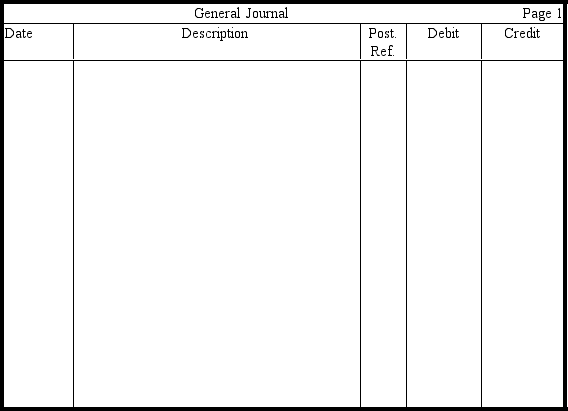

In the journal provided,prepare entries for the following independent transactions.(Omit explanations.)

a.Purchased land and a building on the land for $960,000.The appraised values of the land and building are $350,000 and $650,000,respectively.

b.Paid $5,000 for a sewage system,$15,000 for a parking lot,$1,000 to tear down a shack on land just purchased,and $10,000 for a block wall.

c.Purchased a truck two years ago for $18,000 with an original six-year estimated useful life and $3,000 residual value.After a full two years of use,revised the residual value to $4,000 and the useful life to a total of seven years.Record depreciation for year 3,assuming the straight-line method.

d.Purchased a machine on May 1,2013 (assume a calendar-year accounting period)for $15,000.The machine has an estimated life of 10,000 hours and no salvage value.Record depreciation for 2013 under the production method,assuming that the machine was used 2,000 hours.

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Fair value is the amount for which

Q151: Carrying value<br>A)equals cost minus accumulated depreciation.<br>B)equals cost

Q220: In calculating the depletion of a natural

Q225: A revenue expenditure results in a<br>A)debit to

Q229: Land and a building on the land

Q231: The following machines were purchased during 2013:<br>Machine

Q232: Al's Car Wash purchased a piece of

Q234: Which of the following is not a

Q235: On January 1,2012,Pung Manufacturing Company purchased for

Q236: Match each definition with the correct term