Essay

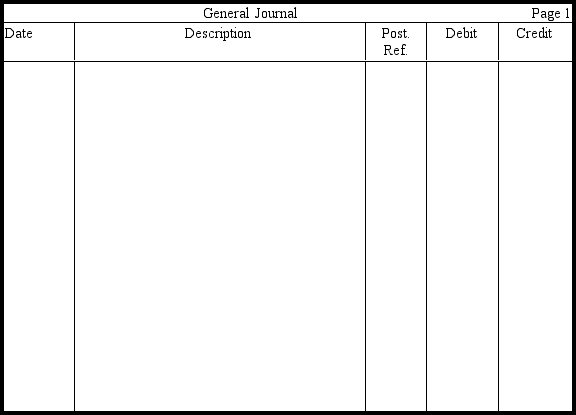

John Jackson obtained a ten-year sublease on a busy corner to open a used car business.To obtain the sublease,he had to pay $14,000 to the current tenant,who had 12 years to go on his lease.The annual cost of the lease is $18,000.In addition to paying for the sublease,Bob paid $10,000 to pave the lot.The paving will have no residual value after its useful life of ten years.Prepare entries in journal form to record the following (omit explanations):

a.The payment for the sublease

b.The payment for the paving

c.The lease payment for the first year

d.The expense,if any,associated with the sublease for the first year

e.The expense,if any,associated with the paving,using the straight-line method for the first year

Correct Answer:

Verified

Correct Answer:

Verified

Q48: When an intangible asset becomes worthless,<br>A)it should

Q69: A tractor held by a farm equipment

Q89: Depreciation for tax purposes is identical to

Q115: What is goodwill and when may it

Q210: Depreciation refers to the periodic allocation of

Q210: A delivery truck was purchased for $32,000

Q211: A company purchases for $24,000 an asset

Q213: Which of the following accounting principles best

Q217: Which of the following would not be

Q220: A graph depicting yearly depreciation expense under