Multiple Choice

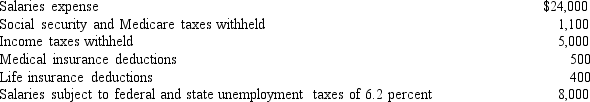

Use this information to answer the following question. The following totals for the month of July were taken from the payroll register of Greene Company: The entry to record the accrual of federal unemployment tax (assume FUTA tax of .8 percent) would include a

The entry to record the accrual of federal unemployment tax (assume FUTA tax of .8 percent) would include a

A) credit to Federal Unemployment Tax Payable for $64.

B) debit to Federal Unemployment Tax Payable for $64.

C) debit to FUTA Tax Expense for $64.

D) credit to Payroll Taxes and Benefits Expense for $64.

Correct Answer:

Verified

Correct Answer:

Verified

Q31: All of the following are estimated liabilities

Q147: What would be the adjusting entry for

Q151: A business accepts a 9 percent,$25,000 note

Q152: Seacrest Company purchased a machine on January

Q153: First City Bank computes interest semiannually.If the

Q155: Use this information to answer the following

Q156: Use this information to answer the following

Q157: The days' payable shows how long,on average,a

Q158: The following totals for the month of

Q159: All of the following can be employee