Essay

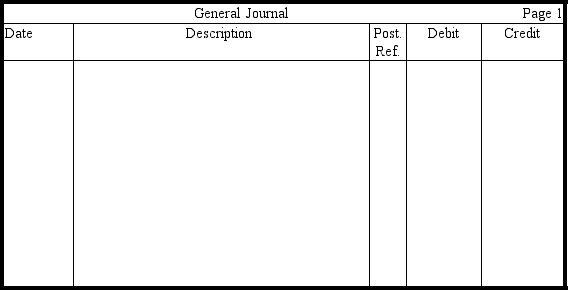

Caplan Corporation uses the accounts receivable aging method to account for Uncollectible Accounts Expense.As of December 31,Caplan's accountant prepared the following data about ending receivables: $20,000 was not yet due (1 percent expected not to be collected),$10,000 was 1-60 days past due (4 percent expected not to be collected),and $2,000 was over 60 days past due (8 percent expected not to be collected).At December 31,Allowance for Uncollectible Accounts had a credit balance prior to adjustment of $200.In the journal provided,prepare Caplan's end-of-period adjustment for estimated uncollectible accounts.Also prepare the entry that would have been made had the credit balance instead been a debit balance.Omit explanations.

Correct Answer:

Verified

Correct Answer:

Verified

Q52: The allowance for uncollectible accounts is similar

Q54: Because bad debt losses are incurred to

Q56: Match the following terms with their definitions.<br>-Interest<br>A)Year

Q73: The higher the receivable turnover,the lower the

Q75: A bank reconciliation begins with the balances

Q76: During the month,a company learns that a

Q77: In a petty cash fund,the current cash

Q79: The general ledger account for Accounts Receivable

Q80: Explain the difference between the two methods

Q83: Cash equivalents are categorized as cash on